Masterclass on Price Action Trading Strategies

Vendor: Elearnmarket

Only logged in customers who have purchased this product may leave a review.

Description

Advanced Technical Analysis Course Highlights

- 7+ hours of on-demand content

- 25+ hours of Live Interactive Sessions

- 4+ hours of Live Trading Sessions

- Q&A Session with Experts

- Whatsapp Community Support

- Trade Discussions

- Certificate of Completion

Introduction

Trading will remain a gamble for you as long as you enter the market without a well-defined strategy. You usually get into trading with excitement, but you frequently lose your hard-earned money due to a lack of understanding of market dynamics.

Another challenge you deal with is analyzing and forecasting the movement of stock prices to recognize potential trading opportunities. So, to make an informed decision, you will identify market trends, analyze the price action, determine entry and exit points, and manage risk effectively.

Considering the above factors, we have curated this course to teach you classic chart patterns and candlesticks to assess market trends and identify potential opportunities.

Masterclass on Price Action Trading Strategies is a live and self-paced course where you will get hands-on experience to trade in the live market. You will get handholded for a specific duration by the industry expert who will guide you on how to time the markets, understand the market trend, determine the correct entry & exit points and manage the risk effectively.

Please find below the overview of the topics covered in this Masterclass on Price Action Trading Strategies course:

Topic 1: Basics of Technical Analysis

- Understand the philosophy behind technical analysis and know the price movements over time and volume, and open interest.

- Analyze the market trend with the six tenets of Dow Theory.

- Know how to identify and use trendlines, support, and resistance levels for trading decisions.

- Identify and interpret classical chart and candlestick chart patterns to predict future price movements.

- Understand gap theory and how gaps in price charts can provide trading opportunities.

- Gain knowledge of technical indicators and oscillators used to analyze price movement.

- Understand the entry and exit levels using fibonacci tools and learn various fibonacci tools.

- Delve into various trading strategies to implement in various market conditions.

- Know the importance of psychology in trading, risk management methods, and strategies for managing capital.

Topic 2: Trendline, Support and Resistance

- Identify Support and Resistance: Through this course, you will learn the concept of price action and how demand and supply determine the price of the stock and support and resistance levels. Also, you will get a deep understanding of using charting tools like TradingView to draw and spot support and resistance levels in real-time price movements.

- Formation and Use of Trendlines: Then, you will explore the formation of trendlines to identify the historical trend of the price movements and understand how to determine the trend of the market to identify the trading opportunities.

- Spot Reversal Trades and Breakouts/Breakdowns Trades: Moving on, you will identify potential reversal trades using trend angles. And also understand how to spot breakout and breakdown movement.

- Determine the Stop Loss and Target: At the end, you will gain an in-depth understanding of how to set stop loss and target. And you will also get to know the various methods to trail the stop loss.

Topic 3: Overview of Trading Software

- Frameworks of Trading Tools: You will explore various trading software and tools such as StockEdge App to track & analyze the stocks, TradingView for chart analysis and Trading Terminal (Zerodha) to execute the trades.

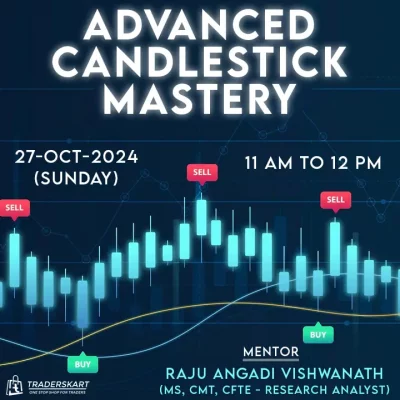

Topic 4: Classical Chart Patterns, Candlestick Patterns and Technical Indicators

- Interpretation of Classical Chart Patterns: Moving on, you will understand how to spot and analyze the various classical chart patterns such as double top and double bottom, head and shoulder, inverse head and shoulder, symmetrical triangle, ascending and descending triangle, and many more to forecast future price movements.

- Analyze various Candlestick Patterns: Then you will identify and interpret the different types of bullish and bearish candlesticks, such as hammer, shooting star, doji, bullish and bearish engulfing, and many more, using TradingView. So, you will be able to set the stop loss and target levels based on the candlestick patterns.

- Interpret various Technical Indicators: Moving forward, you will gain comprehensive knowledge to interpret Moving Averages, MACD (Moving Average Convergence Divergence), Bollinger Bands and RSI (Relative Strength Indicators). Furthermore, you will also know how to utilize these indicators for identifying short-term momentum trade, medium-term and swing trades.

Topic 5: Advanced Technical Analysis Techniques & Trading Strategy

- Explore Fibonacci Tools: Then you will get an in-depth understanding of advanced techniques such as Fibonacci retracement, Fibonacci expansion, Fibonacci fan, Fibonacci arcs and time zones and learn how to predict stock prices using these tools.

- Implement Advanced Trading Strategy: At the end of this advanced technical analysis course online, you will understand how to implement the advanced strategy “Golden Swing Strategy” and analyze the risk-reward ratio. Here, you will also know how to manage your position-sizing to gain potential returns.

Want to know more, speak to our Program Advisor, call +91 9748222555.

About the Trainer

Souradeep Dey

Souradeep has a rich experience of 14 years as an equity and commodity trader and trainer. He has worked as a crude oil trader for 3 years for FuturesFirst and has traded in the ICE exchange in Europe. He is involved in developing trading algorithms with technical analysis as his main area of interest.

What Will You Learn in Advanced Technical Analysis Course?

- Understand support and resistance levels, draw trendlines, and analyze classic chart patterns and candlesticks to assess market trends and identify potential opportunities.

- Execute breakout trades using stop-loss and target levels to capitalize on significant price movements and minimize potential losses.

- Use moving averages, MACD, RSI & Bollinger Bands for short-term momentum and swing trading.

- Apply advanced tools such as Fibonacci retracement and extension levels and learn to implement the Golden Swing strategy.

- Analyze position sizing, risk-reward ratio, and trading psychology for success.

Reviews

There are no reviews yet.