UP-Algomojo

Vendor : Algomojo

Notes : Once you subscribe to the Product. Our support team will reach out you within 24 hours to facilitate the installation of the necessary licenses and software. Feel free to contact us via email ([email protected]) or call us at (+91 8550 828 828) for any further assistance or services you may require.

Only logged in customers who have purchased this product may leave a review.

Description

Algomojo is a web-based trading bridge for sending orders automatically to the exchange. It is India’s first web-based trading bridge that comes at Free API cost for Algomojo users who open a trading account via Algomojo. It is built by traders for traders to provide better trading experience with minimalistic user design. Algomojo comes with Integrated all-in-one solutions (API, free & proprietary Strategies, Datafeed, Virtual servers, and end to end support at one single marketplace). It helps traders to simply their Algo trading and makes life easier for the traders.

Features of Algomojo

Currently Algomojo supports Trade execution from Amibroker, Metatrader, Excel and Custom Designed Trading Platforms(Dot Net, Java, Python,NodeJS) via Algomojo API.

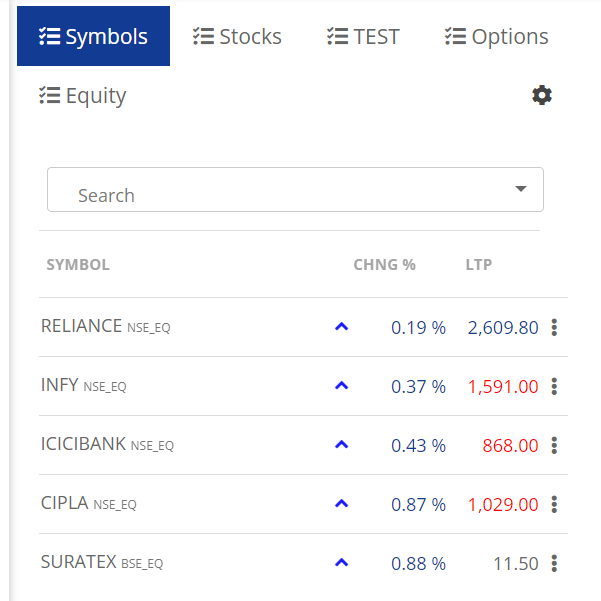

Watchlists

Supports lightweight watch-list with minimalistic design and easy to use interface to add symbols and multiple watchlists. Dashboard to Track Funds, Positions, Orders, Holdings & MTM Profit/Loss.

Manual Orders

One can place manual orders (Intraday, Delivery) and currently supports Limit Orders, Market Orders, Bracket Orders, Cover Orders.

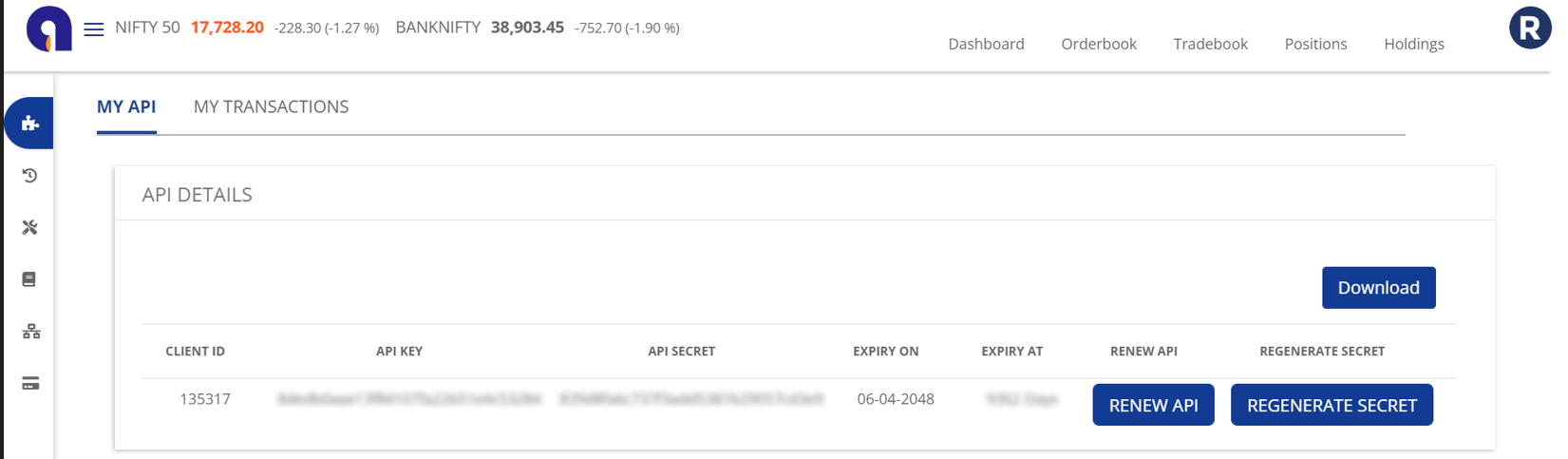

Algomjo API

Algomojo comes with inbuilt API which also supports existing clients of partner broker with 7 days of free trial enabled by default.

Order Log

Order Log is provided to verify the timestamp and audit the difference between the executed trades and generated live signals in the trading software.

OrderBook :From the Orderbook one can get both the status(pending, executed, rejected) of manually punched orders and trading software-generated orders.

TradeBook : Tradebook shows executed orders.

Positions

Any open positions can be viewed in the positions section. One button square off is provided to close all the open positions and also positions can be closed on a symbol selection basis. Positions also displays intraday and position MTM.

Holdings:

Demat account holdings can be viewed and managed under the holdings section.

Supported Trading Bridges

Currently Algomojo comes with ready made bridge for Amibroker, Metatrader and Excel with minimal interface between the Algomojo and the Trading software.

Strategy Library

Traders are recommended to come up with their own trading strategies. If in case looking for sample codes then free strategies can be downloaded from the Algomojo Library.

Datafeed

Datafeed section provides users to subscribe for NSE Cash, NSE Futures, NSE Currencies and MCX Futures and Options. Supports various charting platforms like Amibroker, Ninjatrader, Excel both desktop and server editions. We partner with Globaldatafeeds and Truedata to distribute their products. 3 days of Datafeed Trial will be enabled to all the users of Algomojo to test run their strategies before live exection.

Virtual Private Servers

VPS servers or Virtual Private Servers are the primary need for the algo traders who want 100% uptime with sufficient Internet and Power Backup. One can directly subscribe for windows VPS servers.

End to End Integration Support

One can get end to end integration support to configure, test & deploy trading strategies.

Following end to end support will be provided to the Algomojo clients.

1)Integration of Algomojo Bridge for Autotrading.

2)Integration of Datafeed (Amibroker, Ninjatrader, Excel etc)

3)Integration of Windows VPS Servers.

3)Testing and Deploying the Trading Strategies.

And also in case the trader needs a custom trading strategy to be coded in Amibroker/Metatrader. On-demand Freelancing support will be provided to onboard the client with custom design strategies.

Algomojo API Documentation

AlgoMojo API documentation is comprehensive to know about the various functionalities supported by the trading platform. It helps traders to build their own execution logic. Also the trading system designers using the interface of Python, NodeJS, Java, etc who want the complete set of API they can send their mailers to [email protected]

Additional information

| Subscription Period | 30 Days, 180 Days, 365 Days |

|---|

Reviews

There are no reviews yet.