kLintra V5.0

Vendor : TradeStudio

Notes : Once you subscribe to the Product. Our support team will reach out you within 24 hours to facilitate the installation of the necessary licenses and software. Feel free to contact us via email ([email protected]) or call us at (+91 8550 828 828) for any further assistance or services you may require.

Only logged in customers who have purchased this product may leave a review.

Description

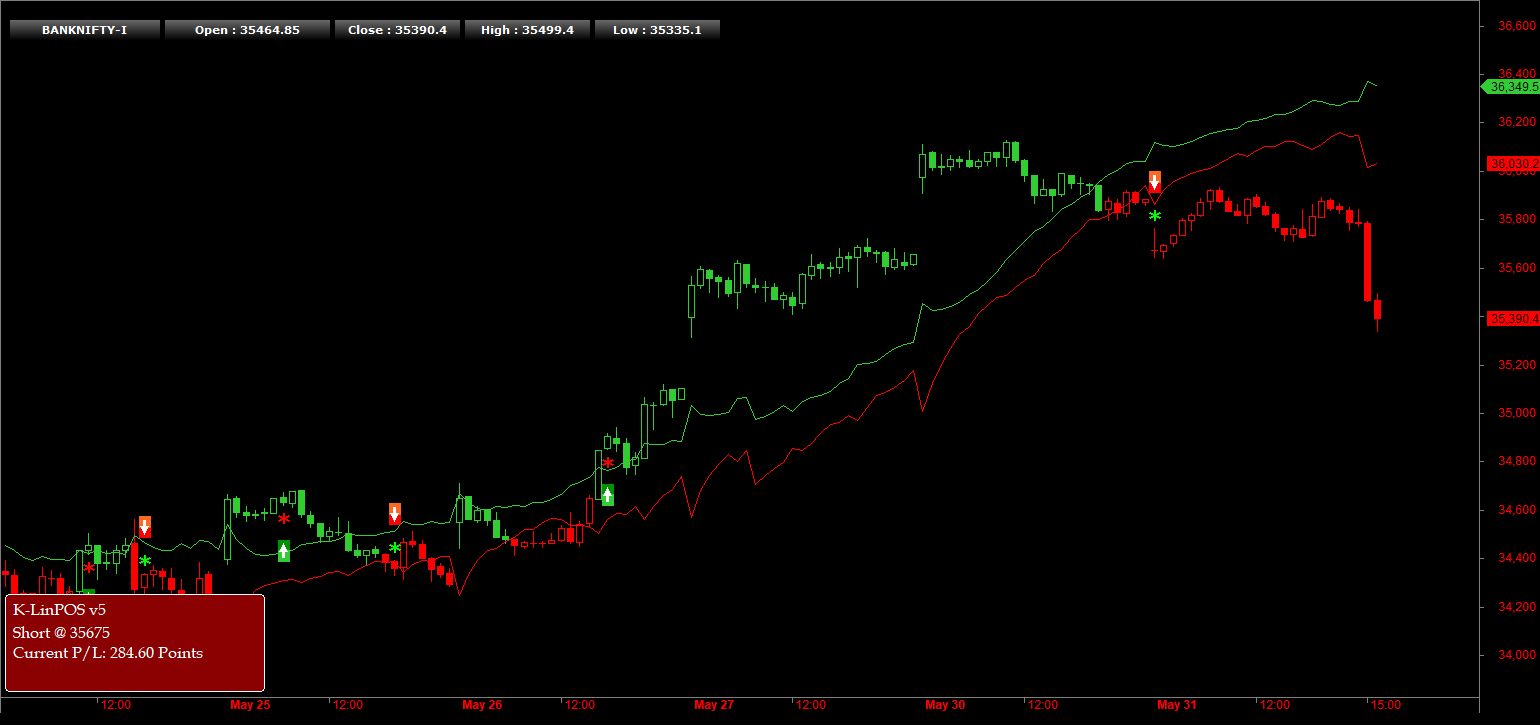

Klintra V5 is a trend-following system based on Kaufman Adaptive Moving Average + Linear regression-based volatility channel with adaptive parameters based on four different volatile seasons.

Trading System Type : Positional

Supported Software: Amibroker (32-Bit) – 6.0+ or higher version

The primary objective of the KLintra V5 trend following system is to capture the positional trends and bringing consistency in return and optimal stop loss from the Klintra V5 band itself thereby maximizing the overall gain of the portfolio.

What is a Trend Following System?

According to Wikipedia, Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue.

Traders who employ a trend-following strategy do not aim to forecast or predict specific price levels; they simply jump on the trend (when they perceived that a trend has been established with their own peculiar reasons or rules) and ride it.

Backtesting Performance

In order to test the system parameters following parameters are used

| Parameters | Value |

| Trading Instrument | BankNifty Futures |

| Backtesting Timeframe | 15min timeframe (Continous Data) |

| Backtest Length | Jan 2011 – May 2022 |

| Strategy Type | Volatility based Trend Following (Positional) |

| Position Size | 1 Lot Size |

| Slippage + Commissions | 0.02% |

| Trading Capital | RS 2,00,000 |

| Current Trading Margin as of 6th Aug 2021 | Rs 1,64,432/Lot or 18.23% NRML Margin |

| Preferred Execution Type | Entry Limit Order and Exit Market Order |

| Fixed Stoploss | 1.0% |

| Fixed Target | 5.0% |

| Signals in Futures and Execution in Options | Yes Possible |

| Which Option Strike to Select | 4 Strike ITM (Ensure Sufficient Liquidity is available) |

Rough Theoretical Brokerage Charges involved in a typical Buy and Sell Transaction with Bank Nifty at 35,000 levels

| Parameters | Value |

| Total Turnover | Rs 1750000 (Buy Side + Sell Side) |

| Brokerage | Rs 40 |

| STT total | Rs 88 |

| Exchange txn charge | Rs 35 |

| Clearing charge | RS 0 |

| GST | Rs 13.5 |

| SEBI charges | Rs 1.75 |

| Stamp duty | RS 17.45 |

| Total Charges | Rs 195.75 (0.011%) |

| Points to breakeven | 7.83 points |

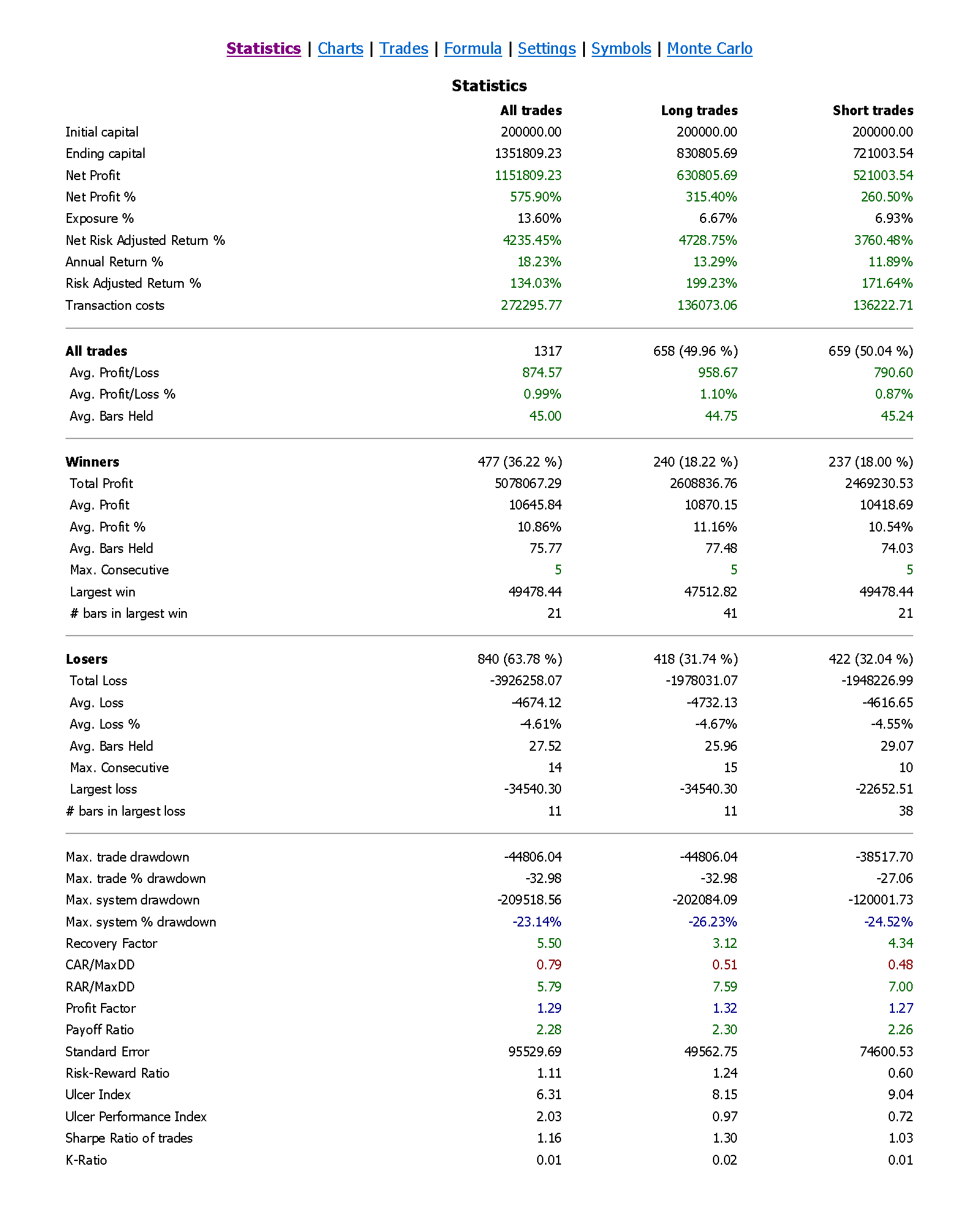

Backtesting Results

kLinTRA V5 – Complete Backtesting Report

Key Backtesting Performance Metrics

| Key Performance Metrics | Value |

| Sharp Ratio | 1.16 |

| Max System Drawdown | 2.09L/lot (unhedged risk) |

| Calmar Ratio (CAR/MDD) | 0.79 |

| Recovery Factor | 5.50 |

| Profit Factor | 1.29 |

| Payoff Ratio | 2.28 |

| Risk-Reward Ratio | 1.11 |

Trading Parameters

| Parameters | Values |

| ATR | 80 |

| len1 | 125 |

| len2 | 150 |

| len3 | 150 |

| len4 | 150 |

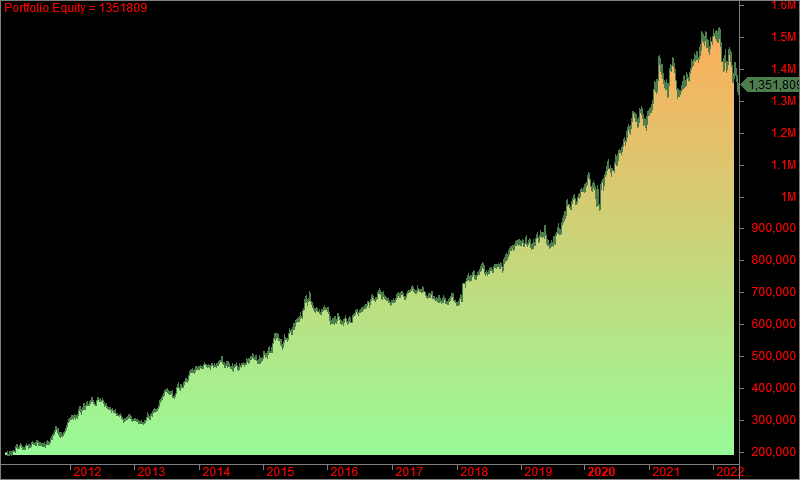

Equity Curve

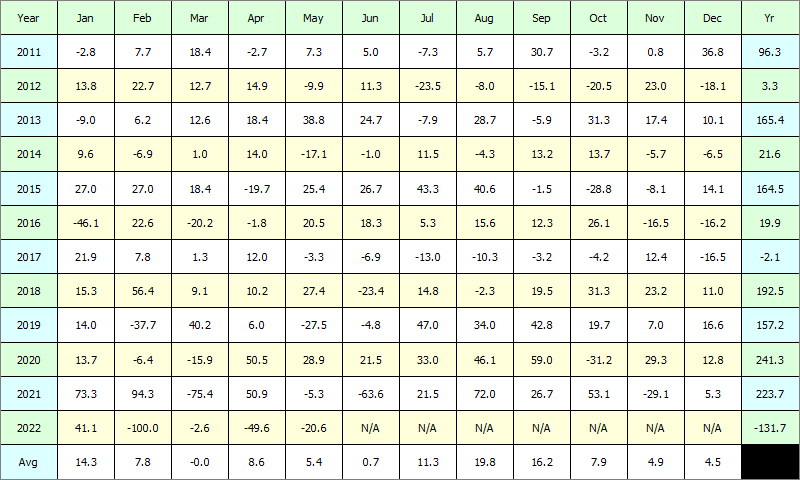

KLintra V5 – Absolute Profit Table (In thousands)

Additional information

| Months | 1 Month, 3 Months, 6 Months, 1 Year |

|---|

Reviews

There are no reviews yet.