Lintra V3.2

Vendor : TradeStudio

Notes : Once you subscribe to the Product. Our support team will reach out you within 24 hours to facilitate the installation of the necessary licenses and software. Feel free to contact us via email (support@traderskart.in) or call us at (+91 8550 828 828) for any further assistance or services you may require.

Only logged in customers who have purchased this product may leave a review.

Description

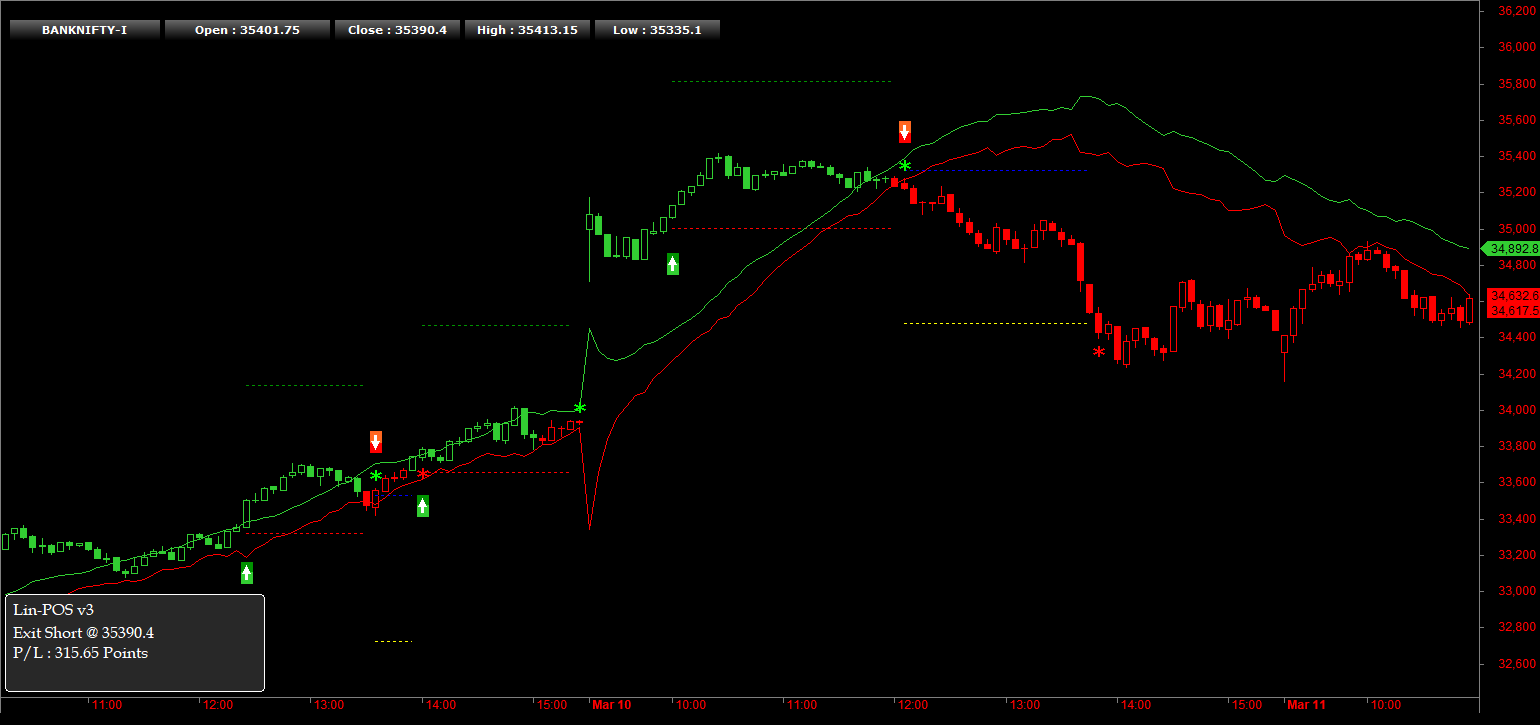

Lintra V3 – is a linear regression-based trend following an intraday trading system to trade in Bank Nifty (Futures and Options Trades). It is a simple volatility-based breakout trading system to take advantage of intraday price action moves.

Trading System Type : Intraday

Supported Software: Amibroker (32-Bit) – 6.0+ or higher version

The primary objective of the Lintra V3 trend following system is to capture the intraday trends and bring profitable returns and reduce the risk with dynamic stoploss and target from the Lintra v3 band itself thereby maximizing the overall gain of the portfolio.

What is a Trend Following System?

According to Wikipedia, Trend following or trend trading is a trading strategy in which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue.

Traders who employ a trend-following strategy do not aim to forecast or predict specific price levels; they simply jump on the trend (when they perceived that a trend has been established with their own peculiar reasons or rules) and ride it.

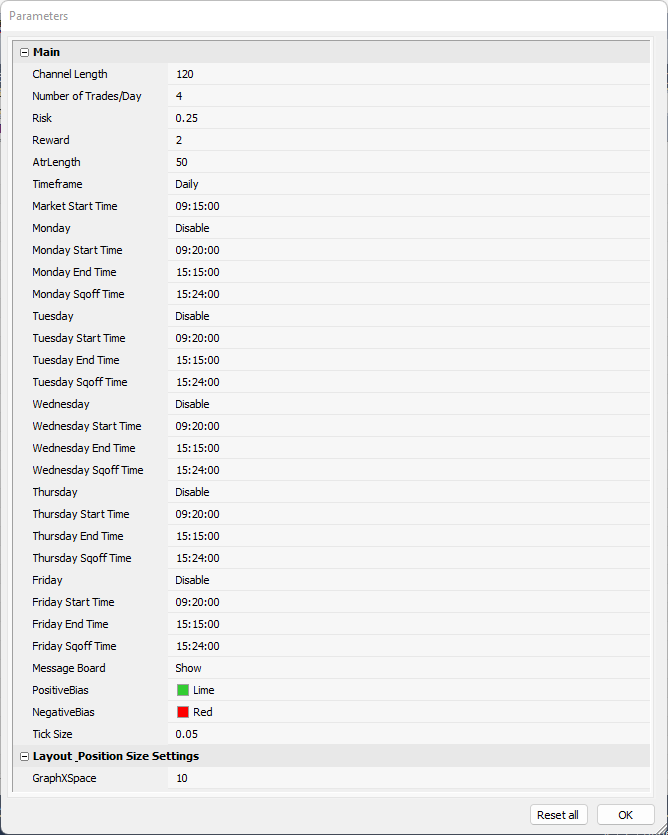

Parameter Settings

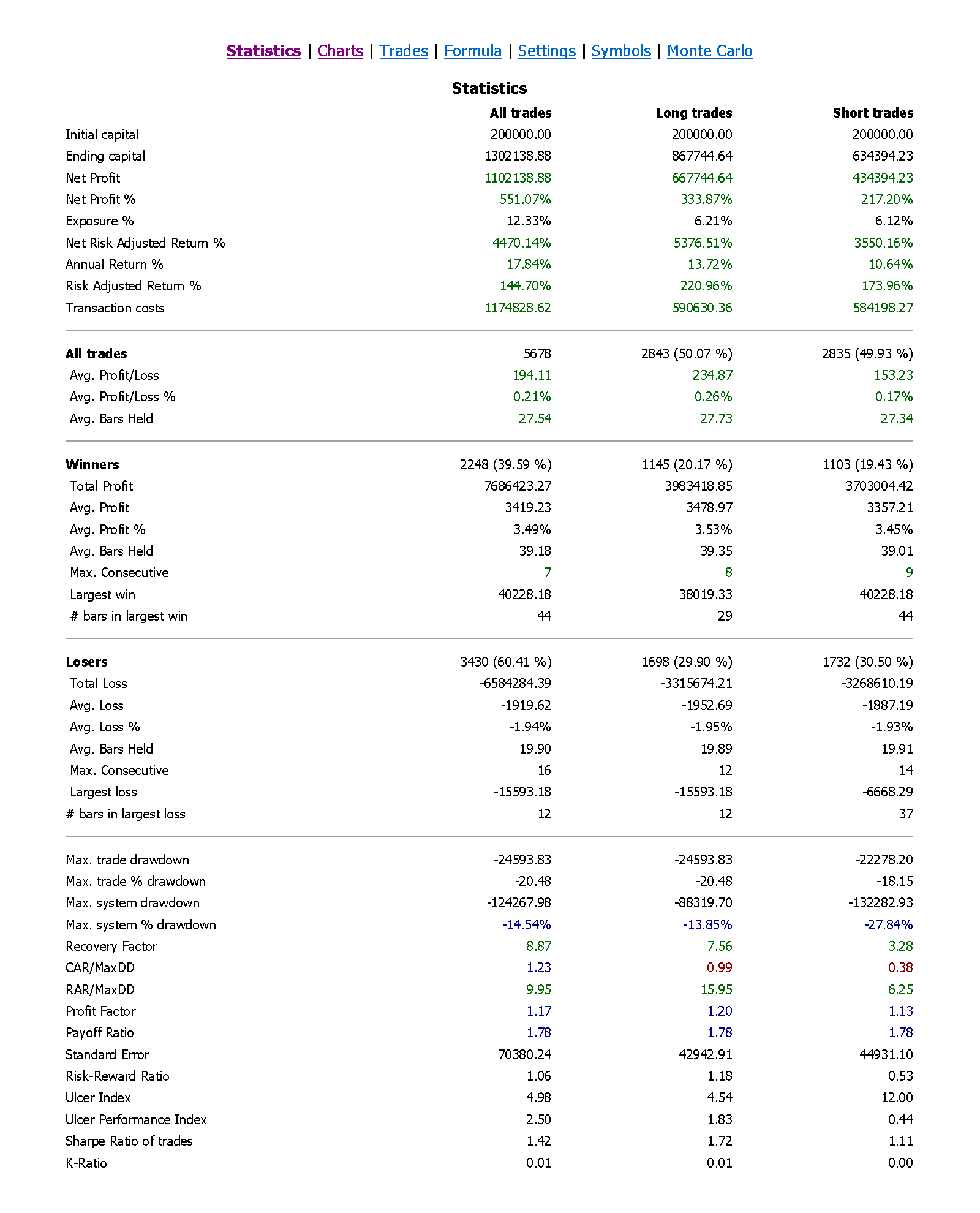

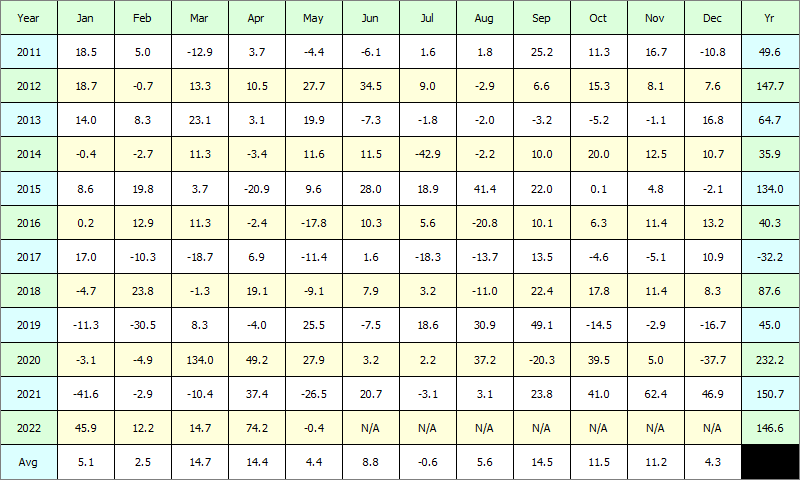

Backtesting Performance

In order to test the system parameters following parameters are used

| Parameters | Value |

| Trading Instrument | Bank Nifty Futures |

| Backtesting Timeframe | 5min timeframe (Continous Data) |

| Backtest Length | Jan 2011 – May 2022 |

| Strategy Type | Volatility-based Trend Following |

| Position Size | 1 Lot |

| Slippage + Commissions | 0.02% |

| Trading Capital | RS 2,00,000 |

| Current Trading Margin as of 6th Aug 2021 | Rs 1,50,432/Lot or 15.48% NRML Margin |

| Execution Type | Market Order |

| Dynamic Stoploss | 0.25 times of ATR |

| Dynamic Target | 2.00 times of ATR |

| Signals in Futures and Execution in Options | Yes Possible |

| Which Option Strike to Select | 4 Strike ITM (Ensure Sufficient Liquidity is available) |

Rough Theoretical Brokerage Charges involved in a typical Buy and Sell Transaction with Bank Nifty at 35,000 levels

| Parameters | Value |

| Total Turnover | Rs 1750000 (Buy Side + Sell Side) |

| Brokerage | Rs 40 |

| STT total | Rs 88 |

| Exchange txn charge | Rs 35 |

| Clearing charge | RS 0 |

| GST | Rs 13.5 |

| SEBI charges | Rs 1.75 |

| Stamp duty | RS 17.45 |

| Total Charges | Rs 195.75 (0.011%) |

| Points to breakeven | 7.83 points |

Backtesting Results

Download LintraV3 Backtesting – Complete Report

Key Backtesting Performance Metrics

| Key Performance Metrics | Value |

| Sharp Ratio | 1.42 |

| Max System Drawdown | 1.24L/lot (unhedged risk) |

| Calmar Ratio (CAR/MDD) | 1.23 |

| Recovery Factor | 8.87 |

| Profit Factor | 1.17 |

| Payoff Ratio | 1.78 |

| Risk-Reward Ratio | 1.06 |

Trading Parameters

| Parameters | Values |

| Channel Length | 120 |

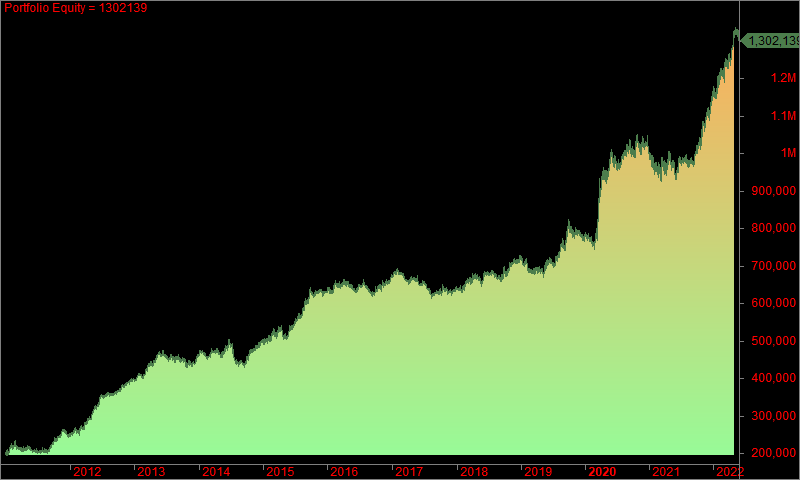

Equity Curve

Profit Table (Absolute Value in Thousands)

Additional information

| Months | 1 Month, 3 Months, 6 Months, 1 Year |

|---|

Reviews

There are no reviews yet.